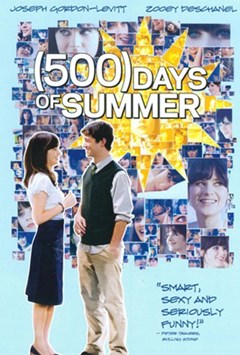

500 DAYS OF SUMMER

«You know, I dream sometimes about flying. It starts out like I’m running really, really fast. I’m, like, superhuman. And the terrain starts to get really rocky and steep and then I’m running so fast that my feet aren’t even touching the ground.»

«You know, I dream sometimes about flying. It starts out like I’m running really, really fast. I’m, like, superhuman. And the terrain starts to get really rocky and steep and then I’m running so fast that my feet aren’t even touching the ground.»

Sole Finn (Zooey Deschanel) in 500 days of summer by Marc WeBB.

«Running really really fast» is the image that describes the trend of the JP Morgan shares last Friday (+ 4.7%), after the publication of the financial statements. The numbers speak for themselves: in 2019 first quarter, profits increased by 5% compared to the same period in 2018, thus reaching 9.18 billion dollars. The EPS (earnings per share) is therefore equal to 2.65 dollars. The revenues are rising too, from 27.91 billion dollars to 29.1 billion. Data beats the expectations of analysts who anticipated earnings per share of 2.35 dollars and revenues of 28.44 billion dollars.

Wells Fargo also published the quarterly, but there was no «being a superhuman», in fact the title ended Friday, April 12 session’s with a loss of 2.6%. Despite the good results in the first quarter of 2019, profits reached 5.86 billion dollars, up from the 5.14 billion dollars recorded between January and March 2018. The earnings per share stand at 1.2 dollars, surpassing analysts' estimates of 1.09 dollars. Revenues fell slightly, to 21.61 billion from 21.93 billion of the first three months of 2018 but, in this case too, forecasts of 21.01 billion were beaten. The Wells Fargo share has been weighed down by the statements of CFO John Shrewsberry, who predicted a drop in interest margins during 2019.

But the American quarterly don’t stop there: Citigroup closed the first three months of 2019 with a net profit of 4.7 billion dollars if compared to last year’s 4.6 billion. Goldman Sachs, on the other hand, ended the period with profits down of the 21% on an annual basis to 2.25 billion.

In the United States operators are optimistic about the progress of the trade negotiations between Washington and Beijing. During the weekend the US Treasury Secretary, Steven Mnuchin, said that he was confident that the two superpowers are now nearing the final stage, stressing that the agreement, which is still being defined, goes far beyond previous efforts to open up the Chinese market to USA’s businesses. The "really really fast run" to reach a compromise therefore seems close to an end.

On a monetary level, Donald Trump managed to keep the investor’s morale up thanks to his new attack on the Federal Reserve led by Jerome Powell. The president of the United States wrote on Twitter that if the central bank had not raised rates over the past year, the GDP would have grown more and Wall Street would have registered an even more marked bull market. The tenant of the White House continues in fact to support an expansive policy by the Fed.

In the Old Continent, the Council of the European Union has given the green light to adopt the negotiating directives of the EU Commission for trade talks on eliminating tariffs on industrial products with the United States.

On the Brexit front, the United Kingdom's request to delay the exit date initially scheduled for March 29 and already postponed to April 12 was accepted. The new deadline is set for October 31. The delay was necessary to avoid the no-deal, the investors’s most feared hypothesis, after the repeated failures of the proposals presented by premier Theresa May to the British Parliament.

As for JP Morgan and Wells Fargo, it is quarterly time also for Vivendi. Revenues between January and March 2019 grew thanks to the solid performance of the subsidiary Universal Music Group and the consolidation of Editis, which took place in February. In particular, the French company’s turnover reached 3.46 billion euros (+ 10.7% compared to 3.12 billion of last year’s first quarter and beyond the estimates of 3.39 billion). However, the share failed to "run really really fast" and recorded yesterday a slight rise.

The same goes for the European indexes that yesterday closed, basically, with timid percentage increases. And at the horizon, for the moment, it is difficult to foresee a boom of the markets’ pace.