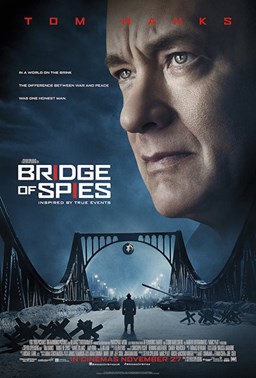

BRIDGE OF SPIES

“Every man is important. (James B. Donovan)

“Every man is important. (James B. Donovan)

I am Irish, you are German, but what makes us both Americans? Just one thing, one, one, one: the rule-book, we call it the constitution and we agree to the rules, and that is what makes us Americans, it’s all.

Do you never worry?

Answer: would it help?

"Just tell that you’re not going to be in any danger. I don’t even care if it’s the truth, give me something to hold onto", Jan Donovan

“The boss isn’t always right but he is always the boss”.

From the movie “Bridge of spies” by Steven Spielberg.

In the middle of the cold war, the Brooklyn lawyer James Donovan (Tom Hanks), is called to defend the Soviet spy Rudolf Abel, to show how the United States guarantee a fair trial to any defendant. Donovan manages to spare the accused the death penalty by supporting the thesis that a dead Russian spy is useless, but alive could become a bargaining chip.

Years later Donovan repatriates the U.S. Air Force pilot Francis Gary Powers, whose U-2 spy plane was shot down during its first flight in the Soviet skies, in exchange for Abel.

The commercial war has already become a war of spies, or perhaps, what is coming to light is that everything had already begun, in silence, years ago, and the American and Chinese 007 were already giving them a sound beating.

Someone identifies it as a new cold war, where supremacy is not sought in the field of missiles, but in that of the technological future of the planet, the processing of data, the control of networks, tech and artificial intelligence. The battlefield is no longer the territory but the inhabited part of the network and, as always, the wealth.

The1st of December, but the news was only announced at the end of the week, Meng Wanzhou, CFO, vice president and daughter of Huawei's founder, Hua Zhengfei, was arrested in Vancouver. The United States have requested her extradition because of the suspicion of violation of the USA’s trade sanctions against Iran.

The Chinese reaction, as always, does not aim to raise its voice, to make noise, but at the same time is very concrete and clear. The Beijing Foreign Ministry has convened Terry Branstad, the American ambassador in China. The Chinese authorities protested about the arrest of Huawei's vice president in Canada.

The republican senator Ted Cruz has no doubts: Huawei, the Chinese colossus already boycotted by the Usa, "is a Communist Party spy agency thinly veiled as a telecom company. Its surveillance networks span the globe and its clients are rogue regimes such as Iran, Syria, North Korea & Cuba ".

The man that in 2016 ran (in vain) for the Republican nomination, won by Donald Trump, considers the arrest of the CFO of the group, Meng Wanzhou "both an opportunity and a challenge". What is going to happen next is crucial. The Chinese Communist Party cannot risk damage to their reputation that the transparency of a trial will bring, and they will do everything possible to intimidate the Canadian government to send her back to China". Instead of extradite her in the USA, where she is accused of violations of sanctions related to Iran. "Our ally Canada must stand strong and extradite her to the United States, where she will face something China does not have: a fair, impartial justice system".

On one hand investors are keeping an eye on international events, hoping that Trump will intervene and soften the situation. On the other hand they look at the macro data. The stock market reacts with a drop of the Chinese currency that is losing value, reaching 6,89, whilst the yield of China's ten-year bond reaches the lowest value of the last year and a half, hitting 3,25%.

In China in November the inflation reached +2,2% from October’s +2,5%. The growth in production’s costs has also been below expectations. These data give room for maneuver to the Chinese monetary authorities, from which the markets are awaiting stimulus and supporting measures.

The bonds go up and their yield goes down, not only in China, but all over the world.

The US Treasury Note quotes at 2,84% on the ten-year maturity, the lowest of the last four months.

Several investment banks consider the possibility of two rate hikes in the United States during 2019: until few weeks ago the Consensus was expecting at least three of them. One, in December 2019.

The effect of Opec’s cut in production of 1.2 million barrels per day didn’t last much. Thanks to the turbulence, gold goes above 1,250 dollars an ounce, the highest since July. On Friday, the precious metal closed the best week since February with a 2% increase.

On the one hand international tensions, on the other those regarding global growth. The question is not whether “one is worried or not”. The answer is the creation of a defensive portfolio, more than in the past. So far, choosing to focus more on bonds and less on growth stocks is paying off.