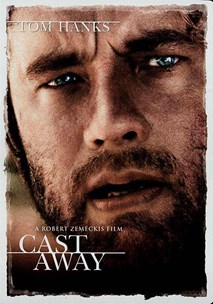

CAST AWAY

“I have to keep breathing. And tomorrow the sun will rise, and who knows what the tide will bring in.

“I have to keep breathing. And tomorrow the sun will rise, and who knows what the tide will bring in.

“Stan: Kelly had to let you go. You know ? She thought you were dead. And we buried you. We had a funeral and a coffin and a gravestone. The whole thing.

Chuck: You had a coffin ?

What was in it ?

Stan: Well, everybody put something in. You know, just a cell phone or a beeper, some pictures. I put in some Elvis CDs.

Time rules over us without mercy, not caring if we’re healthy or ill, hungry or drunk, Russian, American, beings from Mars. It’s like a fire. It could either destroy us or keep us warm.

“Eighty-seven hours is an eternity. The cosmos was created in less time ! Wars have been fought and nations toppled in 87 hours ! Fortunes made and squandered.”

From the movie “Cast Away” by Robert Zemeckis.

Liquidity is about to return, the foundations are laid, in case of need, a return to the field. Some members of the ECB have already anticipated that the next move could be a plan of subsidized loans to banks, Tltro. The stock has arrived in a desert island, we must keep breathing because tomorrow the sun will rise and who knows what the tide will bring.

The tide, the liquidity, has already being injected by central banks and could rise again, with new tools. The next meeting of the ECB, on March 7th, may already be the right date to announce a program of bank support. Immediate the reaction of the market, with Italian financial institutions that have toasted to the news, especially those with a patrimonial situation under stress. From the Federal Reserve also come indications of some members who expect a slowdown in tapering, probably already on March 20th. The Chinese central bank is much ahead, and is thinking of making perpetual some classes of debt, a financial fantasy at unknown levels even for the most experienced magicians in the industry.

Still from the Chinese front come other good news. Donald Trump is optimistic about the results of remote meetings with President Xi Jinping. He said that he was ready not to trigger the ultimatum, which provided for an increase in automatic tariffs if an agreement had not been reached by March 1st. Monday night, on the tide of rumors that say the agreement is close, the Asian stock exchanges have closed with a marked upward trend. In recent days, even Wall Street has celebrated.

The operators are now convinced that the two main market brakes, the trade relations between China and the US and the restrictive policies of the central banks are about to melt like snow in the sun.

However, reality is a bit more complex. The world does not go in the same direction in a univocal way. Space-time variables in this economy are increasingly important. Time rules over us without mercy, not caring if we’re healthy or ill, hungry or drunk, Russian, American, beings from Mars. It’s like a fire. It could either destroy us or keep us warm.

Let's start from space, from Europe. The Continent now seems to be marked by strong differences. Germany is desperate for skilled workers. In Italy, unemployment, even if it has returned to pre-crisis levels, is still at 10.8%, with the youth’s rate still growing. In Spain unemployment is at 14.45%, still high but the lowest of the last 10 years. England is a world apart. According to a report prepared by the National Institute of Economic and Social Research: “If the government’s proposed Brexit deal is implemented, then GDP in the longer term will be around 4% lower than it would have been had the UK stayed in the EU. This is roughly equivalent to losing the annual output of Wales or the output of the financial services industry in London.”. If Great Britain remained indefinitely in a customs union with the EU or if the “backstop”, the insurance policy on the Irish border, was used, the damage would be minor but still substantial, with a decrease of 2.8% of the GDP or 70 billion pounds. If the British Parliament rejected the agreement proposed by the Government and Great Britain came out of the EU without an agreement, the so-called "no deal" option, then the contraction of GDP would be 5.5% or 140 billion pounds.

Let's now move on to the other variable: time. We are on the eve of the European elections, on the agenda from the 23rd to 26th of May. By now, eleven governments of the Union are supported by a majority of anti-system movements. Beyond all different Euro-sceptic streak from country to country, nationalist parties are in power in Italy, Austria, Poland and Hungary; but also in Bulgaria, Finland, the Czech Republic, Slovakia, Greece, and Romania and now Latvia.

Faced with these markets, pushed, from time to time, by different currents within the background– the fears of an economic recession, the central policies of the central banks, the commercial tensions and the elections, we feel like castaways, alone, fighting not to be at the mercy of the current. The struggle is to keep breathing because the sun will rise tomorrow, or to identify those ideas that can make us see beyond the horizon of these variables, even too cyclical, for a long-term portfolio.