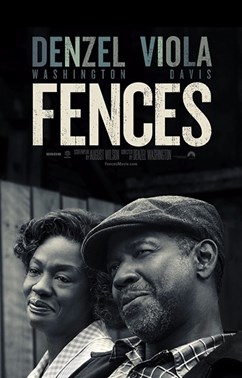

FENCES

"There are those who create barriers to keep people out and who to keep people inside. Your father wanted you to be everything he was not and at the same time he wanted you to be everything he was. I do not know if he was right or wrong; but I know for sure that it was more aimed at doing good than harm. Do not spend your life worrying if someone likes you or not, you'd better make sure they treat you as you deserve. If you play the juggler with too many balls, sooner or later one falls, it's a matter of common sense.

"There are those who create barriers to keep people out and who to keep people inside. Your father wanted you to be everything he was not and at the same time he wanted you to be everything he was. I do not know if he was right or wrong; but I know for sure that it was more aimed at doing good than harm. Do not spend your life worrying if someone likes you or not, you'd better make sure they treat you as you deserve. If you play the juggler with too many balls, sooner or later one falls, it's a matter of common sense.

Based on the film "Fences" by Denzel Washington.

We are all convinced that barriers are a boundary that arises from relationships with the outside, towards the other. In the film by Denzel Washigton, the barriers have another origin. They arise from our inner limits and very often in the name of the will to do good and not evil. There is no desire for a separation, but the goal is growth.

Chinese culture rejects competition, seen as the road that puts people in opposition and denies the benefits of sharing. It is more than an economic confrontation that is in progress. And also a different view of the economy. It is not the Chinese people who live the intellectual property as a good to be defended. Very often intellectual property is conceived as a good that must be shared to accelerate the growth of all. Of course, in all this, there is a lot of hypocrisy

On the other side of the world, from the US point of view, low-cost production, indifferent to minimum social standards, environmental protection, and intellectual rights are an attack on free competition, understood as a race on equal terms where the best it can emerge.

Extraneous to this battle, or better still in a deafening silence, is Europe.

In the United States there is already talk of China Effect. Political sensitivity to the appeal of populism, strong in the areas most negatively affected by globalization, in the form of the entry of competition from the products of the People's Republic.

The China Effect is therefore the level of economic insecurity that it creates, different according to the district and to the productive specializations. Perhaps, now, it becomes clearer how the barriers that Donald Trump raises, and China’s response are born from within not from the outside. They have always existed; globalization has only highlighted them, because it has highlighted the contrast. Europe so far is silent because the largest economy in the area, Germany, is a net exporter and would not have much to gain by supporting the US.

The paradox of this, now a virtual war of duties, is that about + 130% of the Boeing stock market from the beginning of November 2016 and + 71% of Caterpillar against 24% of the S & P500, it would seem that the effects of the customs policy of Trump are completely marginal on the stock exchange. "Trump has given" with the rally lasted 15 months and "Trump is taking off", but the race of many US companies is largely supported by the presence in China. Difficult to think that the duties destroy the whole performance.For the first quarter of 2018 expectations are for the very good S & P500 profits, or better, the best for 7 years, up 18.4% and over 19% for the whole of 2018. The numbers for the index are less exciting. European Stoxx 600 with expected profits up 3.4% in the first quarter and 8% in the whole year.

If we look at the whole world, according to the International Monetary Fund, Asian growth in 2017 stood at 5.6% will remain at 5.6% this year with China at 6.8% and 6.5% a year respectively next and India + 6.7% and + 7.4% to lead the race. According to the Fed, the US GDP should grow by 2.8% this year and slow to 2.4% next year. Now, beyond our mental and cultural barriers, we must ask ourselves whether tariffs are the real reason for a transfer of the stock exchanges and whether it is easier to let go of the fear of a slowing world or instead observe growth.

It is useful to remember that the markets have their own vent valves and automatic depreciation. An increase in tariffs could result in a change in exchange rates that can reposition the competitiveness of domestic products— as well as an improvement in the cost structure of the most affected companies or a change in the supply of products. In the face of tariffs, we must try to limit our mental barriers: stop believing that Chinese growth is based only on low-cost exports, that markets follow every word of Trump and focus on the major changes taking place. China, India continue to run. Europe is growing but not uniformly. All the rest are the real barriers.