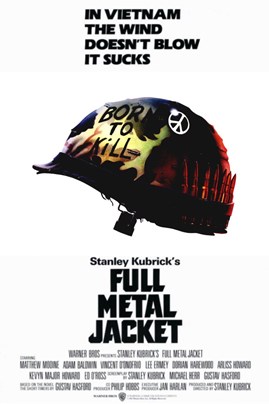

FULL METAL JACKET

Sergeant Hartman: “If you miss, you will finish this course ... and if you survive the training ... you will be a weapon! You will be dispensers of death and you will pray to fight! But until that day ... You're not even human beings, you'll just be shapeless pieces of amphibious organic matter. Here there are no racial distinctions…Equality is in force here! My orders are to skim all those who do not have the necessary guts to serve in my beloved body! Understand, filthy worms?!

Sergeant Hartman: “If you miss, you will finish this course ... and if you survive the training ... you will be a weapon! You will be dispensers of death and you will pray to fight! But until that day ... You're not even human beings, you'll just be shapeless pieces of amphibious organic matter. Here there are no racial distinctions…Equality is in force here! My orders are to skim all those who do not have the necessary guts to serve in my beloved body! Understand, filthy worms?!

The rifleman's credo” "This is my rifle, there are many like him, but this is mine, my rifle is my best friend, it's my life, I must dominate my life. Without me, my gun it is nothing, without my gun I am nothing. I must know how to hit the target, I must shoot better than my enemy who tries to kill me, I must shoot before he shoots at me and I will. My rifle and myself, we are the defenders of the country, we are the rulers of our enemies, we are the saviors of our life and so be it, until there will be no more enemy but only peace, amen ".

From a film by Stanley Kubrick, Full Metal Jacket.

On Friday night, the US, Britain and France launched 105 missiles on three targets in Syria. Lightning war, intelligent war. War. The US has already announced that it has hit Assad's chemical weapons bases. The Pentagon claims the goal but admits that it does not know if Assad owns the others. The markets fear a military escalation at a time when the stock exchanges were already volatile and after a long rally, excuses were being sought for breath.

Government rumors say the attack was wanted on Friday night, giving investors two days to digest that there will be no escalation. But the truth is that nobody can know it. Will Assad will react? Is Moscow watching? It will also depend on the targets hit. For years, there have been talks about intelligent missiles, but in the past they have been very distracted

Market historians ran all the time back to analyze what happened on the main indices during the war. Grenada '81; Panama '89; Gulf Wars '91 and '93; Afghanistan '01; Libya '11. In the month preceding the outbreak of the conflict, the US stock market lost 0.6% on average. Subsequently, in the first thirty days of war, the price list grew by 4% instead. The increase, then, has reached the average of 7.2% over the 6 months period. In short: during the period of expectation of the future conflict, share prices fall. Then, when the war breaks out, the stock market raises its head. It weighs more uncertainty if there is a conflict than the conflict itself.

The markets have always surprised us by explaining, with the numbers, that every time it is new. In the past there have never been escalations; the indices did not reach the peak of the period, the weight on the stock market of companies linked to the war market was much greater than now, the US front was much more compact than it is today, Syria it is a powder magazine of religions, geopolitics (between Russia, Europe, the Middle East and US interests), very close to Europe.

To this, it might be added, that the United States is already conducting another war on tariffs with China, which will take advantage of the situation and that, on the finance side, central banks are ready to sterilize the enormous liquidity while the dynamics of the deficit Use worries. After these reasonings, it is clear that the heart of the problem is if the conflict will remain circumscribed temporally and above all geographically. The second aspect that has long worried the markets is Trump's basic strategy. Is there a strategy? The American president tones up, to get what he wants, but is he ready to lower them soon after or is a warmonger?

This doubt is circulating among the operating rooms with insistence. The economist Keynes, a pragmatic pacifist, fought on the economic convenience of wars, wondered if it was permissible to start one without questioning whether the future peace is better or less than the current one; and if it was reasonably possible to foresee the successful outcome of a war. Of all investments the one that enjoys the greatest Keynesian multiplier is in the arms sector. The missiles are not only destroyed and "rebuilt" but disintegrate other activities that in turn must be rebuilt. On this dynamic are starting to be a bit 'of questions, on when, on how, on who is the beneficiary and above all on costs. Today is not the past, and on the lists weigh more the tech companies than the weapons ones.

We do not like wars because we do not ask ourselves whether the price lists have risen or not during the war but if they have risen more without war. We love free markets and wars always cause obstacles to capital, to ideas, to people. We have a growth perspective, in the short, medium and long term, wars break this harmony. Our best friend is not a rifle is a currency understood as a wealth that bears fruit and does not kill. So surely from the investments in the arms industry will be born ideas as it was for the internet and much more. Today we are interested in those companies that will be able to transform these ideas into growth. We expect volatile markets, rising oil and gold, currency tensions. We will ride them with a view to increasing their value.