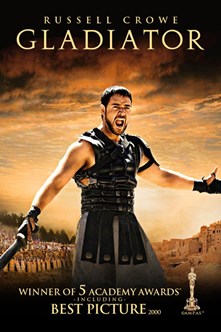

GLADIATOR

Maximus: «Whatever comes out of these gates... we have a better chance of survival if we work together. You understand? We stay together, we survive».

Maximus: «Whatever comes out of these gates... we have a better chance of survival if we work together. You understand? We stay together, we survive».

From the movie The gladiator, directed by Ridley Scott.

«We have a better chance of survival if we work together. You understand? We stay together, we survive». The meaning of Maximus Decimus Meridius (Russel Crowe)’s words in The gladiator is the same as for the industrialists' call to vote in Europe. "Our unity is our strength", declared Vincenzo Boccia for Confindustria, Dieter Kempf for the German Bdi, Geoffrey Rouz de Bézieux for the French Medef. The leaders of the associations of the three main manufacturing countries of the continent have also added: "We, as entrepreneurs and as citizens, need to send a strong signal to our national governments and to the rest of the world: Europe matters to us."

The question is: will the Europe of the future be stronger and more united, as hoped by industrialists, or more fragmented and weak? It is not easy to answer today, because the path to further EU integration is still long, and everything will depend on the concrete choices that the various states and Community institutions will take in the coming years.

What we know with certainty is that a complex political picture has emerged from the European elections, even though the anti-EU forces are weaker than expected. The so-called sovereign parties win in some countries (League in Italy, lepenists in France), but remain minorities on the Continent. The EPP continues to be the first force, followed by the Socialists (PES) and the Liberals (ALDE): these three groups together have an absolute majority in the European Parliament. Good results for The Greens, who increased their support in several EU countries. In the United Kingdom, Nigel Farage's Brexit Party claims more than 30%; LibDems follows (almost 19%), ahead of Jeremy Corbyn's laborers (14%). The conservatives collapse under 10%, in the grip of a severe crisis. A tearful Theresa May announced last week her resignation, speaking of deep regret over the fact that she hasn’t "been able to deliver the Brexit".

In general, the markets are still confident about the continent's destiny: the majority conquered by the pro-European forces is seen as an element of solidity and the operators are hoping for growth-oriented policies. For these reasons on Monday morning the main European lists have opened up. At Piazza Affari Fiat Chrysler Automobiles shares jumped (+ 8%), after the group’s announcement of a merger proposal at par with Renault. The result of this fusion will be the creation of the third automotive hub in the world, with a strong positioning in new technologies (including electric and self-driving vehicles), and a complete portfolio of brands, from luxury models to the most popular ones. If the transaction will be successful, according to FCA’s proposal, the future company will have a joint governance structure and a majority of independent directors. The merger will not entail any closure of factories. For Fiat and Renault, as well as for Europe, the key to success could be the same: to work together.

Let’s move on to the commercial war between the United States and China: the hope is that the fighting will cease and there will be peace. Donald Trump was optimistic about the possibility of concluding the agreement, despite the fact that recently the clash has been revived with the introduction of further tariffs. "I think sometime in the future China and the United States will absolutely have a great trade deal, and we look forward to that", said the American president. Trump may meet his Chinese colleague Xi Jinping during the G20, which will take place in Japan at the end of June. From a macroeconomic perspective, according to the April preliminary reading, durable goods orders in the United States decreased by 2.1% on a monthly basis. The result disappointed the analysts’ consensus, who expected a less marked fall (-1.8%).