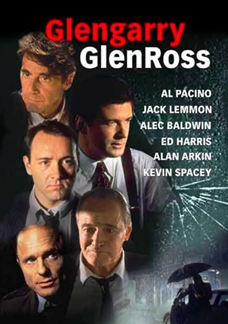

GLENGARRY GLEN ROSS

Ricky Roma (Al Pacino): «Our life is looking forward or looking back, nothing else. This is our life. Where is the present? And what is it that scares us so much? Losing... What else? “

Ricky Roma (Al Pacino): «Our life is looking forward or looking back, nothing else. This is our life. Where is the present? And what is it that scares us so much? Losing... What else? “

Quote from the film Americans, a 1992 movie, directed by James Foley. Original title: Glengarry Glen Ross

For Ricky Roma, the character of Americans played by Al Pacino, “life is looking forward or looking back, nothing else.” But if we think about the prospect of the markets, life is above all looking forward to potential future scenarios. And now, we are monitoring the present to understand the possible evolution of events. Currently, the focus is on the escalation of Covid-19 infections: what impacts will it have on the economy in the coming months? The impact will also depend on the actions of the governments, which are currently moving in the direction of more stringent restrictions. The markets are hoping, however, that full lockdowns, like those seen during the first wave, will not be needed.

In the United States, to respond to the impact of the pandemic, experts are hoping for a rapid agreement on fiscal stimulus between the government and the opposition. However, the timing seems to be lengthening, especially after the recent face-to-face on CNN between House Speaker Democrat Nancy Pelosi and White House Chief of Staff Republican Mark Meadows. The heated debate leads us to think that, probably, the agreement will not be concluded before the presidential elections on November 3rd. The remaining differences also concern the expected amount expected, with the administration which looks like putting 1.880 billion dollars on the plate, against the Democrats, demanding 2.200 billion.

The Federal Reserve also intervened on the matter, urging the parties not to waste time and to act as soon as possible. Lael Brainard, who sits on the board of the US central bank, has “looked ahead” and said that the failure to approve the fiscal stimulus will be major damage to the economy. In particular, he made it clear that “the premature withdrawal of financial support would risk entrenching recessive dynamics, slowing down employment and spending, increasing the scars due to prolonged periods of unemployment, leading more companies to close and, ultimately, damaging production capacity. With the likely persistence of unemployment and shorter working hours, it is unlikely that many of these families, without additional financial support, will be able to sustain the consumption around recent levels, neither the debt pressure on loans or the evictions on their mortgages”.

Always looking forward, it is difficult for an investor not to wonder who will win the next American presidential elections, also because the plans of Donald Trump and Joe Biden are diametrically opposite. It is enough to think to the energy market: the first wants to favor the national oil sector, while the second focuses on the green transition. To date, the polls give Biden a winner, but it is always better not to take anything for granted.

In Europe, there is news on the macro front from the continent’s first economy. The data of the IFO index relating to Germany have been published and this highlights the confidence of companies regarding prospects (here again, we are looking ahead). In October it dropped to 92.7 points, a figure lower than expected (93) and the previous result (93.2). However, the evaluation index of the current German situation is positive, and recorded an increase to 90.3 points, against the previous 89.2 and above the forecasts of 89.8.

Turning to the ECB, the Institute also looks forward, analyzing the impact of the pandemic. Christine Lagarde, Eurotower number one, recently said that the growth in infections represents “a clear risk” for the economic outlook, strengthening the expectation among investors of further initiatives to support the markets and the economy. The spotlight is on Thursday when the board of the European Central Bank will meet, although the weighty decisions could come the next month.

On the Brexit front, the negotiations seem to be on the rise and the risk of a No Deal is approaching (the deadline is the 31st of December). The president of the European Council, Charles Michel, warned the Johnson government: “we want to reach an agreement, but not at any cost. A level playing field is essential because it guarantees, for instance, equal industrial production standards with the UK. Without equal standards, there is no access to the EU market without duties or quotas, because this would endanger our jobs”.