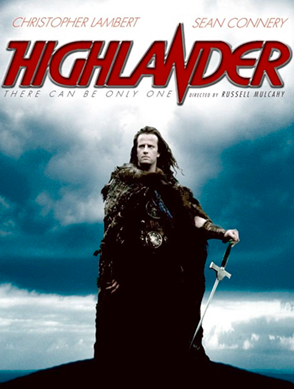

HIGHLANDER

Most people are afraid to die. That's not your problem. You're afraid to live. I've been alive for/centuries. I cannot die. (Connor MacLeod).

Most people are afraid to die. That's not your problem. You're afraid to live. I've been alive for/centuries. I cannot die. (Connor MacLeod).

Connor MacLeod: how did it happen, for God's sake?

Juan Sánchez Villa-Lobos Ramírez: Why does the sun come up, hmm? Or are the stars just pinholes in the curtain of night? Who knows?

What I do know is…because you were born different...men will fear you, try to drive you away...Iike the people of your village.

You have power beyond imagination. Use it well, my friend. Don't lose your head. (Juan Sanchez Villa-Lobos Ramirez)

Connor MacLeod: Help me, I'm drowning!

Juan Sánchez Villa-Lobos Ramírez: You can't drown, you fool. You're immortal!

Juan Sánchez Villa-Lobos Ramírez: You must learn to conceal your special gift... and harness your power... until the time of the gathering.

From the movie “Highlander” by Russell Mulcahy.

Many small fires are lit on the world markets. On the one hand there are worries about a slowdown in world’s growth, on the other, the bonfire of the trade clash between the two superpowers USA and China has never died out. The spotlight this week is on the second round of meetings between the two delegations in Beijing. The meeting between US Treasury Secretary Mnuchin and Chinese. Deputy Premier Liu is scheduled for Thursday and Friday.

However, it is starting to force its way the idea that it will be difficult to arrive at the end of February with an all-encompassing agreement between the two parties, and that it will be necessary an extension of the truce, falling due on 1 March, so that negotiations may continue. It seems the repetition of the Brexit scenario, a continual postponement that tires the markets out.

To benefit from this climate, also thanks to the new dovish course of the central banks, are the core government bonds, with the bund rate which fell below 0.1%, while the Treasury rate is approaching 2.6%.

Also from the USA another fuse is ready to explode. Times are tight, very tight; without an agreement on the wall with Mexico, from February 15 there is the risk of a new block in government activity, but especially on the discussion about the risk of a new shutdown. Meaning, a new drop in consensus for Donald Trump and a further reason for economic slowdown.

Eyes on macro data to better understand how the Federal Reserve will react if the truce in the rate hike is stable, or hanging by a thread. So pay attention to the inflation and retail sales data (Wednesday and Thursday). in the background, the US High Yield funds recorded a weekly inflow of almost 4 billion dollars, the most marked since July 2016.

The European auto sector is suffering, having lost 7.3% in two sessions. The disappointing corporate results and the rumors published by a German economic weekly, according to which the US would be considering three options (depending on the type of car) for the application of tariffs on the sector, is relevant. The original proposal had been frozen last July while waiting for an agreement between the EU and the US, but the Trump Administration seems disappointed by the European attitude.

Contrasting signals from the outskirts, from the one that burns the most in Europe: Italy. Oxford Economics is expecting a decline in Italian GDP also in the first quarter of 2019, after the minus sign of the second half of 2018 and "a zero growth for 2019 as a whole". Analyzing the prospects of the Peninsula on the basis of the most recent economic data, the British consulting firm emphasizes, however, that the risks "are clearly on the downside". It is not that important if the Italian banks have passed the ECB tests on the solidity of assets.

From time to time the markets glance over the Brexit’s negotiations, bored as if in front of a soap opera destined to yet another postponement to extend the deadline.

But there is an event that has not yet been brought back to the fore of economic news and which is soon likely to give further instability to the system: the European elections on the agenda on May 23-26. The result is not obvious and the clash between pro and anti-Europeans is likely to get worse, while the euro slips to its lowest from November on the dollar.

In such situations, investors are looking for the Highlander, the investment that is able to pass without any problem all the macroeconomic and political challenges that the markets will put before it in the coming months: macro data, central banks, USA and China, Brexit , elections. A good manager knows that there is no magic ingredient in the recipe, but it is the combination of the elements and the portfolio that creates the most resilient solution to strong challenges. A mix of bonds and stocks with solid growth capacity, strong currencies, gold, without forgetting a few points on emerging markets. Better the core areas of Europe, diversification. Less challenges or bets, remembering that there are long-short, market neutral solutions that focus on the different strengths of assets given a cycle that runs so fast that it is not capable of keeping the pace.