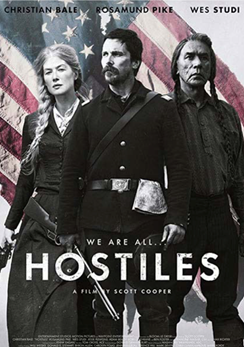

HOSTILES

Joseph Joe Blocker: « Understand this: When we lay our heads down here, we’re all prisoners. »

The quote is taken from the movie Hostiles – 2017, directed by Scott Cooper.

While the situation regarding Covid-19 is currently under control in the majority of the European Union, it appears much more complicated in other parts of the world. Moreover, even in the areas where conditions are better at the moment, it’s still time to be particularly careful, because «if we lay our heads down just for a moment, we are all prisoners», as the captain of the US army Joseph Joe Blocker (played by Christian Bale) says in the movie Hostiles. With the second wave of infections, even the economies that are trying to recovery would go back to be coronavirus prisoners. Within such a framework, markets closely monitor infections and new potential outbreaks evolution.

In general, according to yesterday’s John Hopkins University report, the victims from Covid-19 have exceeded half a million while the number of infected is over 10 million. The United States and Brazil are the most heavily affected nations.

Looking at the markets, on Monday, after the negative performance of Asian Indexes (mainly due to the fear of a new spread of the virus in China and Japan) the European Stock Exchanges have benefited from data published by the Directorate-General for Economic and Financial Affairs of the European Commission. In particular, the index of economic confidence in the countries of the Eurozone stood for June at 75.7 points, against 67.5 in May. However, despite the improvement, the result remained below the consensus of economists, who had predicted 81.7 points. Besides, in the single currency area, the business confidence index rose to -21.7 points from -27.5 points in the previous month. And the service sector indicator also grew (-35.6 points against -43.6 in May).

Also from a macro-economic perspective, last week the International Monetary Fund cut the growth prospects for 2020, forecasting a contraction of the world’s gross domestic product of 4.9% (the April estimate was -3%). The deterioration is due to «a higher degree of uncertainty»; also, the coronavirus pandemic «had a more negative impact on the economy in the first half of 2020 than expected» and therefore the «recovery will be more gradual» than previously assumed. By zooming in, the United States is expected to shrink by 8%, while the Eurozone is expected to shrink by -10.2%.

In the USA, however, some positive signs have come from the Purchase Manager Index, developed by Ihs Markit. SMEs’ data indicate an improvement in the performance of the American economy and, in particular, the composite index rose to 46.8 points in June against 37 in May. But be careful: the indicator remains below the 50-point quota - the threshold that divides the contraction from expansion - for the fifth consecutive month.

The operators also look (with concern) at the resurgence of trade tensions between Washington and Brussels. The US Government is considering imposing new USD 3.1 billion duties on EU exports. Robert Lighthizer, the US trade representative, last week said that goods such as olives, beers and trucks could be affected. Besides, they could increase tariffs by 15% and 25% on various products, such as airplanes, oranges and cheeses.

The spectrum of new duties is linked to the US-EU clash on subsidies for Boeing and Airbus. The World Trade Organization (WTO) had already established that both parties had illegally supported their respective aeronautical industries. And in 2019 the WTO authorized the States to impose duties worth 7.5 billion dollars on European exports. But, to date, the White House has set tariffs that cover about half the value allowed.

Soon, the World Trade Organization should also confirm European tariffs on US products (Brussels has called for tariffs of up to USD 11.2 billion). Even on trade relations, in short, it is better not to lower our guard, or we will end up as a prisoner of duties.