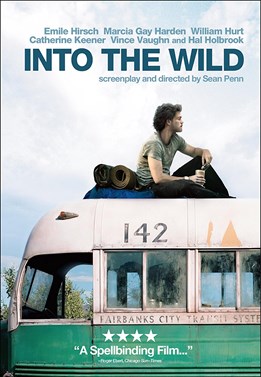

INTO THE WILD

“Rather than love, than money, than faith, than fame, than fairness, give me truth”

“Rather than love, than money, than faith, than fame, than fairness, give me truth”

“There is a pleasure in the pathless woods,

There is a rapture on the lonely shore,

There is society, where none intrudes,

By the deep Sea, and music in its roar.”

“So many people live within unhappy circumstances and yet will not take the initiative to change their situation because they are conditioned to a life of security, conformity, and conservatism, all of which may appear to give one peace of mind, but in reality nothing is more dangerous to the adventurous spirit within a man than a secure future. The very basic core of a man’s living spirit is his passion for adventure. The joy of life comes from our encounters with new experiences, and hence there is no greater joy than to have an endlessly changing horizon, for each day to have a new and different sun... We just have to have the courage to turn against our habitual lifestyle and engage in unconventional living.”

“The fragility of crystal is not a weakness but a fineness.”

From the movie: “Into the wild” by Sean Penn.

If we were to write a tale about the past few weeks, it would be telling the story of the USA against the rest of the world. We would describe Donald Trump as a trade warmonger that aims at checking China’s growth and subduing the other economies. However, all gurus keep proclaiming between three to five reasons for Wall Street to change course. After updating the all-time peak, beating the business cycle’s longevity record, there is only one prophecy: the inversion.

These are the reasons: the rates’ rise; the trade war, the inflation’s pick up, drawn by raw materials, and the increase of the labor cost. The most refined add to them an analysis on market multiples, together with an evaluation of the new cost’s impact.

Trump looks much simpler than how people like to describe him: he is not a conqueror and he might not even be interested in a global vision of the world. On the contrary, he wants to put the United States back in the center. He doesn’t care about having friends or enemies. The only relationship he is interested in, is the one that leads to a positive balance of trade. Period. The rest is speculation. His diplomacy has been extremely underestimated, he actually obtained some results, first with North Korea and then with Mexico. But some things didn’t go very smoothly. Canada’s negotiations for the new NAFTA are stalling.

Leaks report that Trump isn’t going to grant any concession during the negotiations. The USA rejected a UE offer to scrap tariffs on cars.

But the warm front remains with China. The goal, to fight the progress of an economic colossus that aims at beating the USA’s record. However, macro data show that the Chinese growth isn’t really that fast. China's manufacturing activity grew at the slowest pace in more than a year in August, with export orders shrinking for a fifth month. The manufacturing PMI from July’s 50,8 fell to August’s 50,6, as expected, hitting the lowest data since June 2017. We have almost reached the limit: the threshold of 50 points means growth. While waiting for a deal between the two countries (which is not likely to happen), Trump is ready to impose automatic tariffs on 200 billion dollars more in Chinese imports.

On the background the emerging countries’ crisis. Venezuela is devastated, the Turkish currency is collapsing, Argentina seems to be on the brink of a precipice. In Europe, Italy is being monitored every day more closely and the Btp/Bund spread is slowly increasing day after day. Italians await to be reassured by the government: they might have to wait just a little more.

In this tale we are telling, it seems as if everything is already written. Rates will rise, the stock exchanges will fall. The emerging markets and those with high debts are the weakest, and they run the risk of a crash. We have the strange feeling of being trapped in the usual structure. We feel the excitement of an analysis that reassures everyone, because it is the most shareable. Meanwhile, the markets are going in a totally different direction.

It’s the pleasure of walking in pathless woods, without a trail already mapped out. Of being able to have an endlessly changing horizon, to savor a new and different sun each day.

Into the wild is about the “deep” America, which looks at men’s ability of surviving in extreme conditions, far from civilization, as a genuine and inevitable force, that almost ties them to the origin of the world.

Let’s put some distance between us and everything else, from every pre-established analysis, and let’s accept that the markets are pushing towards something new. Towards the world that the central bankers tried to sense at Jackson Hole, because the old and usual models are not able to explain this economic growth. A world where the big global companies, the flexible work, the millennials are pushing towards new equilibriums and a towards a demand where, every day more, immaterial products, such as cloud computing and the shared economy are winning hands down. A world that Wall Street struggles to explain because it is wilder, it uses different rules and less mediators, more flexibility, more adaptation and fewer national borders. A world where the fragility of crystal is not a weakness but a fineness.