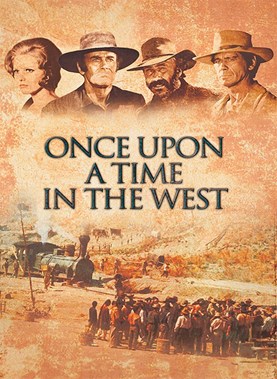

ONCE UPON A TIME IN THE WEST

Morton: Tell me, was it necessary that you kill all of them? I only told you to scare them. People scare better when they're dying. I'm sending you to Yuma, Cheyenne. They got a modern jail there. It's got more walls, more bars, more guards. Oh you'll like it, in 20 years. You'll see.

Morton: Tell me, was it necessary that you kill all of them? I only told you to scare them. People scare better when they're dying. I'm sending you to Yuma, Cheyenne. They got a modern jail there. It's got more walls, more bars, more guards. Oh you'll like it, in 20 years. You'll see.

Harmonica: I saw three of these dusters a short time ago, they were waiting for a train. Inside the dusters there were three men.Inside the men there were three bullets. (Harmonica).

Taking it easy is the first thing a businessman should do.

From the movie “Once upon a time in the west” by Sergio Leone.

Lights off in the USA. The longest shutdown in American history arrived to day 24. The end is not scanned on the horizon. President Donald Trump and the Democratic opponents are at daggers drawn. But the problem is the discontent among the ranks of the Republicans themselves. The result? The American president’s popularity in the polls dropped to 42%.

All politicians and workers are wondering if it was really necessary to go so far just to build a 5.7 billion wall with Mexico. In fact, Trump isn’t going to sign the budget law until the approval of the expenses for the wall.

Beyond the political Faith, the Americans are very concrete: the government's shutdown costs to their economy 1.2 billion a week. Within fifteen days it will reach six billion and exceed the sum requested for the wall.

In this scenario the risk of an economic recession has shot up to the last six years’ highest level. According to a Bloomberg poll, economists said that the world's first power has a 25% chance of recession in the next 12 months. The rating agencies have already warned about the risk of losing its triple-A sovereign credit rating.

Judges, NASA engineers, weather forecasters, white-collar workers from the Sec (Market Authority), museum and zoos workers, over 800,000 state employees did not receive their salary on Friday. The situation begins to be complicated. Another 420 thousand federal employees that are deemed essential for public services are working without being paid.

Many in the USA wonder if it was really necessary to get to this point. Morton : Tell me, was it necessary that you kill all of them? I only told you to scare them.

Frank: People scare better when they're dying.

Wall Street is already grappling with fears of an economy that needs to take a breather, a restrictive monetary policy and a still uncertain climate on the international trade front, which had already triggered the now-revised march of rate hikes.

Even on the other side of the world there are no encouraging indications. Beijing reported a sharp decline in exports in December, while in 2018 car sales fell for the first time since 1990. Immediate market reaction in both Asia and Europe. China's trade surplus with the world fell to 351.76 billion dollars last year, down more than 16% from the surplus of 2017’s 422.51 billion, when, according to data released from Customs, it had contracted by 17%. Total Chinese exports during the year increased by 9.9% to 2,480 billion, while imports increased by 15.8% to 2,140 billion.

The market’s spotlight is on the yuan, the most reliable litmus to understand how the negotiations between the USA and China could continue. The operators (and above all the automatic algorithms that operate on the stock exchange) interpret a depreciation of the yuan as a possible worsening of the state of negotiations, that consequently puts the market in risk-off mode, also triggering massive sales on oil. On Friday, the Chinese bank said it would not tolerate further revaluations of the yuan.

Even the Old Continent is at a crossroad, with the German economy that has grown by 1.5% in 2018, the lowest rate in the last five years, depressed by the global slowdown in the automotive sector.

Once upon a time in the West, that is that the West alone used to dictate the pace of the world’s growth. But it's not like that anymore. The railroad and a few more bullets have swept away the old west. On the markets one of the longest economic cycles ever is coming to an end. In transition phases like these, even in the management of portfolios we are to decisively act in order to cool down some positions and imagine how to emerge from this new cycle with a weaker GDP. Who is going to win, and who to lose? The automotive sector could be at the center of a profound transformation, and the sharp drop in sales does not help. Even the oil sector is likely to be overwhelmed. For banks and insurances, the challenge will be the competition with the new big names of the internet that are aiming to expand also in these sectors. As in the past, the only way not to lose the train is by jumping on it, selecting companies characterized by a high rate of innovation that, among other things, after the recent market declines, have an interesting entry level.