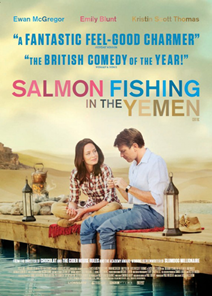

SALMON FISHING IN THE YEMEN

SHEIKH MUHAMMED «Indeed. But fishermen. I have noticed they do not care whether I am brown or white, rich or poor, wearing robes or waders. All they care about is the river, the fish and the game we play. For fishermen, the only virtues are patience and tolerance and humility.»

SHEIKH MUHAMMED «Indeed. But fishermen. I have noticed they do not care whether I am brown or white, rich or poor, wearing robes or waders. All they care about is the river, the fish and the game we play. For fishermen, the only virtues are patience and tolerance and humility.»

From the movie Salmon fishing in the Yemen, by Lasse Hallström.

Just like the fishermen described by Sheikh Muhammed, patience is certainly among the virtues of the Federal Reserve. Once again the US central bank decided to wait and leave interest rates unchanged in a range between 2.25% and 2.5% (values that should remain unchanged throughout the year). Fed Chairman Jerome Powell repeatedly stated at the press conference that: "We do think our policy stance is appropriate right now”, confirming that the Federal Open Market Committee does not think it advisable to deviate from the current path. Why this choice? The current scenario does indeed see the US economy in good health, but inflation remains below the 2% target set by the Central Bank's mandate. Without wishing to minimize the issue, Powell said that there are valid reasons for considering the low level of the general price index, a transitory phenomenon.

But if for the Fed patience is a virtue, Donald Trump considers it as a defect. The American president expressed his opinion via Twitter: "We have the potential to go up like a rocket if we did some lowering of rates, like one point, and some quantitative easing". For his part, at the press conference the president of the US Central Bank reiterated the apolitical nature of the Federal Reserve.

Also, Donald Trump seems to have lost his patience with the trade war between China and the United States. Just when it looked like everything was ready to find a lasting truce, the American president announced the increase from 10 to 25 percent of the tariffs on 200 billion dollars of goods imported from the Asian country. Yesterday, after this news, the Asian stocks plummeted and the European exchanges opened in the red. On Twitter, Trump put it plainly: "The Trade Deal with China continues, but too slowly, as they attempt to renegotiate. No!" And again: "For 10 months, China has been paying Tariffs to the USA of 25% on 50 Billion Dollars of High Tech, and 10% on 200 Billion Dollars of other goods. These payments are partially responsible for our great economic results”.

In the USA, in fact, many results are extraordinary, but proposing them as a partial result of trade warfare is a thesis that does not convince several analysts. Let's talk about numbers: in April in the United States 263 thousand new jobs were created in non-agricultural sectors, a figure clearly higher than the expectations of economists who anticipated an increase of 180 thousand units. There are, however, two problems: wages do not grow as they should and the precarious work share remains high. Good signs come from the productivity index of the manufacturing sector which, in the first quarter of 2019, increased by 3.6% compared to the last three months of 2018 (data released by the Department of Labor), exceeding expectations by + 2.4%.

Moving on to the Old Continent, patience paid off those who were expecting positive inflation data: in the euro area, according to the preliminary reading, in April the inflation grew by 1.7% on an annual basis, speeding up if compared to March’s 1,4% and beyond the expected estimates (+ 1.6%). Core inflation, instead, rose to 1.2% year-on-year. According to several analysts, in April the prices trend has been positively affected by the calendar, due especially to the late Easter holidays. However, the higher than expected inflation convinced the markets, and the major Europeans stocks closed Friday's session (when the data were released) on the upside. The problem arouse Monday morning, with the nasty surprise of the resurgence of the tension between the US and China. What is going to happen now? It is not easy to make predictions. The only certainty is that, like fishermen, we must be patient.