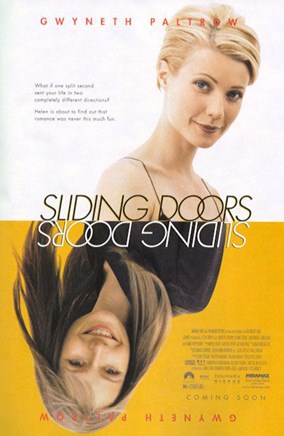

SLIDING DOORS

“- You want my opinion?

“- You want my opinion?

- Will I like it?

- Well, of course not! It'll be based in reality”

“- For God's sake, Gerry. I asked you a simple question; there is no need for you to become Woody Allen.

.- Women don’t ask, they insinuate.”

“They have less questions than these on Jeopardy!”

“you're talking to yourself in the mirror again. Really bad sign!”

There are two sides to every story. Helen is about to live both of them at the same time

From the movie: “Sliding doors” by Peter Howitt.

Trade war or peace? The immediate economic future is at a crossroad. We do not know which way the world will choose, with the two main economies ready to raise the tariff’s wall.

President Donald Trump, while some of his staff members were trying to convince the Chinese vice president, Liu Hue, to go

back to Washington, decided to announce new tariffs on $200 billion worth of Chinese goods. They are expected to be set to be around 10%, a lower level than the possibility of 25% tariffs previously floated. The Wall Street Journal reports that China, initially in favor of renewing the dialogue, did not take it so well: Beijing’s leaders do not wish to send a delegation of the Ministry of Commerce to the USA anymore, if the White House will carry on with its threat. The summit was planned for September 26-27. China doesn’t want to talk with a “gun to its head”.

JP Morgan reports that the effects of a trade war between the USA and China are already pushing the companies to slow down or suspend their investments since, due to this deterioration of the market’s conditions, a reduction of the profits is expected. The investment bank has come to this conclusion after sifting through (with language recognition software), more than 7.000 quarter’s communications. Tariffs are at the top of the list of the manager’s worries.

The ten-year’s bond yield of the United States hit the 3%, the two-years is pushing towards the 2,77%. Investors strongly believe that the Federal Reserve will keep up with the rise in rates whilst ignoring Trump’s explicit moderation demands.

The good set of macro data has helped consolidating the expectation of rates increase, that confirms a strong growth in the USA even during the third quarter. Retail sales, in fact, even if lower than expected, have revealed a good consumption’s trend after the upward revision of the previous data. The industrial production is also speeding up. Considering these data, Atlanta’s Fed has revised upwards, from the 3,8% to the 4,4%, the growth for this quarter’s GDP estimates.

The movie Sliding doors is a tale of two parallel lives: the life of Helen that catches the underground, in the first scenario, and that of Helen that misses it, in the second. From there a succession of very different events, that, in the end, join together and resume the way of the destiny.

The world with tariffs between China and the USA is going to be a tough one, hard to foretell, uncertain, where politics will set the pace, in a scenario where the economic growth is doomed to be slower than in the past. Meaning, the market will have more reasons to fall, after listening to those who have invoked a rectification for a long time now.

The second, instead, is going to be a world that carries on partying, probably able to speed up in the short-term, due to the fact that the uncertainty is diminishing and thanks to the reduction of the international trade’s barriers after the opening of Chinese’s investments and lower tariffs. The Shanghai stock exchange index (today depressed as in 2014) may bounce and the currency war could end too.

Should we believe in destiny and therefore wish that we are going towards a happy ending, like in the movie? On the contrary, the tariffs scenario could become a vicious circle, leading to a growing stiffening of the two superpowers.

The rest of the world is right in the middle. Europe doesn’t seem to be strong enough to look around, divided between those who consider the president of the Bce Mario Draghi’s last intervention too optimistic about growth, and see all dark, and those, instead, who see a low inflation for three years, that may lead to new aids, if necessary.

The emerging countries are merging themselves in the same old and stale issues, that seem unsolvable, with Venezuela’s GDP dropping of a 25%. Argentine and Turkey aren’t in good shape and the Indian rupee is hitting new all-time low against the dollar.

We don’t have a crystal ball, we do not know what is going to happen. What we do know is the chain reaction that is going to be triggered by the two scenarios. Mind this: Trump prefers to negotiate while aiming a gun at China but knows quite well that if he shoots, both will lose. Better to jump on the train of growth.