THE HUDSUCKER PROXY

Board Member 4: What are you suggesting Sidney? Certainly we can't afford to buy an controlling interest.

Board Member 4: What are you suggesting Sidney? Certainly we can't afford to buy an controlling interest.

Sidney J. Mussburger: Not while the stock is this strong. How soon before Hud's paper hits the market?

Board Member 8: January 1st.

Board Member 2: Thirty days.

Board Member 4: Four weeks.

Board Member 5: A month at the most!

Sidney J. Mussburger: One month... to make the blue chip investment of the century look like a round-trip ticket on the Titanic.

Board Member 7: We play up the fact that Hud is dead...

All: Long live the Hud!

Board Member 4: We depress the stock...

Board Member 5: ...to the point where we can buy back fifty percent!

Board Member 6: Fifty-one.

Board Member 7: Not counting the mezzanine.

Board Member 5: It could work!

Board Member 3: It should work.

Board Member 4: It would work!

Sidney J. Mussburger: It's working already. Waring Hudsucker is abstract art on Madison Avenue. What we need now is a new president who will inspire panic in the stockholder.

Board Member 6: A puppet!

Board Member 5: A proxy!

Board Member 2: A pawn!

Sidney J. Mussburger: Sure, sure.

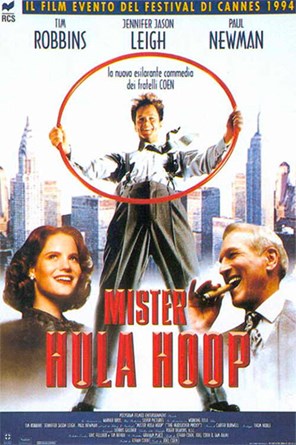

From the movie “The Hudsucker Proxy” by Joel Coen.

It's New Year's Eve. Time stops, just as the fall from the 44th floor (not counting the mezzanine) of Barns, ascended in a short time from postman to leader of a successful businesses. An angel from heaven gives him a second chance: to avoid suicide, take over the reins of the company and defend himself against the accusation of having copied his successful product, the hula hoop, and re-launch the accounts and the ability of making people dream with a new and successful product: the frisbee.

At the beginning of every year the markets try again, they want to go back to dreaming. Investors are looking for a second chance, especially after a 2018 that quickly fell apart at its ending. Risk on markets. The betting is back, supported by four good news. The meeting between the USA and China to discuss trade issues; the cut of the required reserve ratio for Chinese banks; the USA’s labor market data, better than expected; and finally, the softer attitude emerged from the Fed’s Governor Jerome Powell statements regarding the future trend of the USA’s monetary policy. In the first sessions of the year, the stock price lists and the main raw materials recorded a rebound with consequent profit gains on government bonds, in particular the Treasury and the Bund. On the political front, the USA’s shutdown enters its third week, while on the Brexit one Premier May, that will repropose a parliamentary vote on her deal with the around January 15th, has warned that a rejection would bring the UK into an unexplored territory .

The only jarring note, but perhaps widely expected, Apple's profit warning. The merchant banks have set aside the horoscopes, after two years of making bad impressions. 2017, the year of Trump’s election, was supposed to be the year of the collapse, whilst 2018 the year of tech, robots, self-driving cars and artificial intelligence. It happened just the opposite. During this beginning of the year the finance gurus have dealt with individual themes. Apple is being compared to Nokia. It would have been better to predict it before the title left on the ground the 36% in just over two months. The Apple’s group, however, needs to come to terms with it. It cannot go on like this. It needs a Mr. Hula Hoop, someone that after Steve Jobs, after inventing a magical game, the iPhone, will give to the people the chance of carrying on dreaming with new products: the frisbee, for example. The group, with a cash generation of 70-80 billion a year, positioned on one of the most tech sectors of the moment, has the financial and technological possibility to question itself again, to invest or acquire well-positioned companies in new sectors, to review its own strategy and to pull out of the hat that magic upon which the market no longer bets.

But perhaps the merchant banks are right on one thing. After years in which the macro themes, the politics, the individual sectors and therefore the ETF, played the lord and master, now they have intuited a return to the market much preferred by the specialized operators: stock picking, that is, carefully selecting every single equity story. Putting all the Faangs in one basket is a newspapers’ front-page game, but has little to do with quality finance. Amazon's and Netflix’s numbers are different from Apple's. Microsoft, which does not even appear in the Faang, is telling a different tale and has outperformed Apple in capitalization. On the stock market Tesla proceeds in fits and starts but on the streets it’s expanding its market shares, maybe not as fast as expected. But one thing is a failure, a wrong product or fighting with a more fierce competition, another is a simple matter of time.

If in these first days of the year all the wizards and magicians are arousing our enthusiasm with fabulous horoscopes, we prefer to be realistic: 2019 isn’t going to be easy for the stock market. But this means good news for us: it is the market of professionals, because the selection will bring out only the titles and bonds that really deserve to stay afloat, to recover the lost ground. We are not going to lump things together without discrimination, as it has happened in recent months, when we focused on the use of ETF penalizing entire sectors, as if all companies were equal within them To remain on the subject of games, we have already seen the generalization on the stock market, which has always proved itself a boomerang.