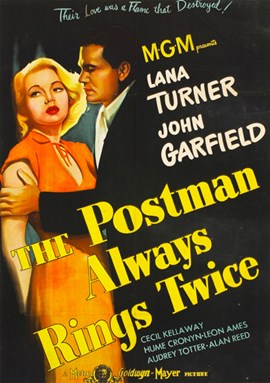

THE POSTMAN ALWAYS RINGS TWICE

Frank: «You know, there's somethin' about this that's like, well, it's like you're expectin' a letter that you're just crazy to get. And you hang around the front door for fear you might not hear him ring. You never realize that he always rings twice».

Frank: «You know, there's somethin' about this that's like, well, it's like you're expectin' a letter that you're just crazy to get. And you hang around the front door for fear you might not hear him ring. You never realize that he always rings twice».

From the movie The Postman Always Rings Twice, by Tay Garnett.

It's a bit like the situation presented by Frank: the Italian government expected a letter. Although it is difficult to think that it is just “crazy to get it”. We are talking about the European Union letter asking Rome for clarifications regarding its public debt, since Brussels considers insufficient the steps taken to contain it. The news flustered Piazza Affari and after the arrival of the letter, on May 29th, the spread Btp-Bund went beyond the 280 basis points. The spotlight is now on June 5th, when Commission reports on EU countries will be released together with, for Italy and four others, the debt report. Italy risks to incur in the infringement procedure: let’s hope that the postman will not ring twice.

As if it wasn’t enough, bad news also came from Istat. The institution has in fact revised downwards the GDP growth results: in the first quarter of 2019 it rose by 0.1% over the previous three months and not by 0.2%. It also has fallen by 0.1% on an annual basis, against the 0.1% increase previously indicated.

A positive signal comes from the Italian manufacturing index: last month it rose from April’s 49.1 to 49.7, jumping to its highest since September and slightly below 50, the boundary line between a phase of expansion and a phase of contraction. As for the Eurozone, in May the data stopped at 47.7, confirming the preliminary estimate, down from the previous month’s 47.9. The main European listings closed yesterday slightly up after a day of volatility.

Moving on to the United Kingdom, the day when the premier Theresa May will formally present her resignation (Friday 7 June) is approaching. The favorite to the succession, Boris Johnson, launched his electoral campaign by promising that Brexit will take place on October 31st, with or without an agreement with Brussels.

On the trade war front, the clash is getting real. The tariff rise announced by Beijing have started on 60 billion dollars of stars and stripes goods, going from 10% to 25%; in the States the 25% tariffs on 200 billion dollars worth of Chinese products entered into force. The Asian country also sent a clear message to Washington, not by post as in Tay Garnett’s film, but releasing a white paper on the trade dispute. The report, presented in eight languages, states that the trade war has not "make America great again", following Donald Trump's electoral slogan. And again: "The tariff measures have not boosted American economic growth. Instead, they have done serious harm to the U.S. economy,”" In the United States, in fact, "production costs and consumer prices have risen, threatening the growth of the economy". China, however, stressed its desire to "work together with the US to find solutions, but will not compromise on major issues of principle". Markets are now awaiting further developments which will lead to a reconciliation between the two superpowers, contrary to what happened in recent weeks. According to some observers, the American president is likely to decide to find an agreement with China in view of next year's elections. Meanwhile, Donald Trump aims higher at Mexico, accused of not stopping the migrants trying to get into the United States. Starting June 10, a 5% tariff on all imported goods from the Mexico into the USA will be imposed. And if Mexico does not act to block the flows, the rates will rise to 10% in July, 15% in August, 20% in September and 25% in October.

From a macroeconomic point of view, in the second preliminary reading, the American GDP grew in the first quarter of 2019 by 3.1%, slightly less than the 3.2% initially forecast but above the expectations of analysts who estimated a + 3%. On the other hand, in May the American manufacturing PMI slipped to its lowest level since 2009 (50.5 points).