WHAT IS NEEDED (IMMEDIATELY)

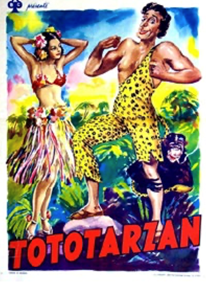

Antonio Della Buffas: «This is civilization: you have everything you want when you don’t need it»

Quote taken from “Totò Tarzan”, 1950, directed by Mario Mattoli.

When Antonio Della Buffas, or Totò in Totò Tarzan, is taken out of the jungle in which he had always lived and comes across western civilization, he is struck by one of his characteristics: having “everything you want when you don’t need it”. This paradigm was hit by the coronavirus pandemic, which led to privileging the essential. In fact, the only economic activities that did not stop were those related to basic goods and services. After the emergency phase, will there be a return to the previous consumerist model, or will there be metamorphoses? Expert opinions are divergent and it will take time to get a clearer picture of future trends; currently, governments and institutions around the world are committed to responding to the immediate needs of the economy, to look at what is needed, now.

Thus, in Asia, the Bank of Japan has deployed all its fi- repower and yesterday announced a strengthening of its expansionary policy. In fact, it has been removed the previous limit to the bond purchase plan: the institution will be able to buy assets in unlimited quantities. In addition, the BoJ confirmed interest rates at -0.1%. Japan’s Gross Domestic Product is now expected to contract between 3% and 5% in 2020.

In the meantime, industrial profits fell heavily in China, in the first quarter of 2020. According to the National Bureau of Statistics’ findings, during the first three months of the year there was a drop of over a third (-36.7%) on an annual basis: particularly hit were the energy (oil and gas) and the automotive sector. Focusing on March, industries’ profits reached 370.66 billion yuan (48.3 billion euros), equal to a drop of 34.8% compared to the same period of 2019.

According to the International Monetary Fund, however, the economy of the Asian country in 2020 will save itself from the minus sign, even if its growth will stop at 1.2% (while next year it is expected to exceed 9%). Looking at what is immediately needed, the People’s Bank of China last week decided to cut the primary one-year lending rate by 20 basis points, from 4.05% to 3.85%. Instead, the five-year rate was cut by 10 basis points (from 4.75% to 4.65%). This is the second reduction in 2020 and new interventions cannot be excluded.

Market focus is now on the Federal Reserve meeting which begins today and ends tomorrow, while Thursday will be the turn of the European Central Bank. Operators do not expect significant news from the US institute, after the extraordinary moves announced in the last month, but the analysis that will emerge will be taken into utmost consideration to understand the evolution of the macro context. While, with regard to Eurotower, more and more analysts are betting on a further expansion of Quantitative easing.

Meanwhile, the Zew Index in Germany describes a “light and shadow” scenario. In fact, one of the main European locomotive component fell heavily, marking -91.5 points in April against -43.1 points of March. This indicator measures the level of trust between various German companies’ finance experts. However, if we consider the segment dedicated to future expectations, there has been a jump in positive territory: 28.2 points from the previous -49.5 with expectations, equal to -42.3 points, surpassed.

According to Achim Wambach, president of the Zew Institute, “financial market experts are starting to see a light at the end of a very long tunnel.” However, the survey reveals that a recovery of the German economy is not expected before the third quarter of 2020.

Looking at the US macro data, the weekly unemployment benefit claims as of April 17 reached 4.43 million units, down from the previous 5.24 million (the forecast was 4.2 million). A picture that could improve if, as said by Steven Mnuchin, the Secretary of the Treasury of the States, most of the economy will re-start again in a few months: “We are about to open other economic sectors and we can’t wait to have most, if not all, of the economy open and running within late summer” he said in an interview to Fox Business Network.